e.l.f. Cosmetics Scales With Strategic Growth Strategy

e.l.f. Cosmetics, Inc.

NYSE: ELF

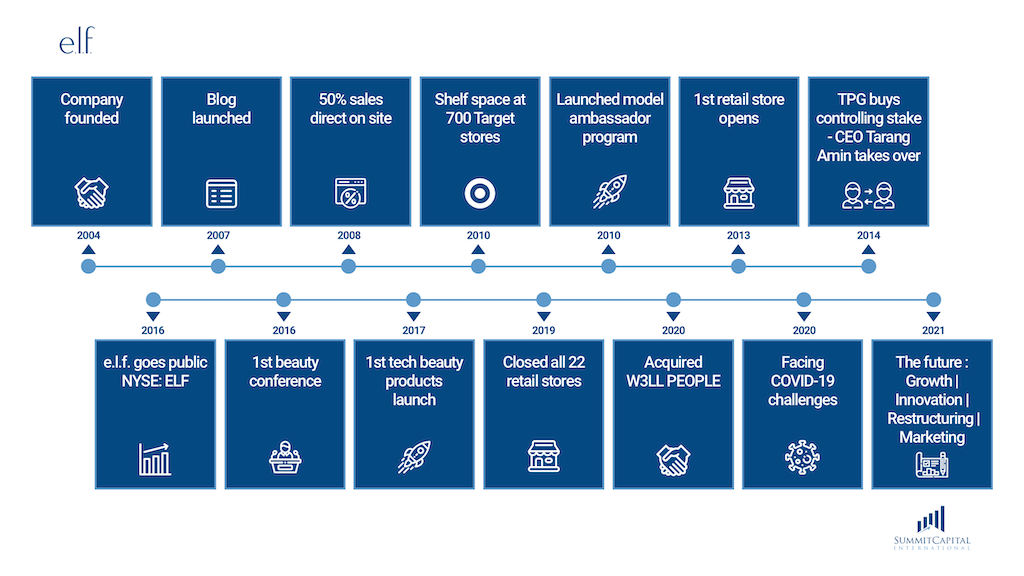

Over 15 years ago, Oakland-based e.l.f. Cosmetics, Inc. started with the goal of producing high-quality but affordable cosmetics for women. Since then, the company’s growth in the US and abroad made e.l.f. a household name in a competitive environment. How did a recent key acquisition propel their growth strategy

The original founders exited the company in 2014 when TPG Growth purchased a majority stake in the company. The company went public in 2016 (NYSE: ELF). Since then, CEO Tarang Amin has led e.l.f into a period of strategic growth, most recently resulting in six consecutive quarters of net sales growth.

Organic vs. Strategic Growth

e.l.f. didn’t simply rely on organic growth. e.l.f. started the decade by charting a course for strategic growth. They knew that in order to reach the masses and scale their product line, they needed to implement an aggressive acquisition strategy. In March 2020, e.l.f. acquired W3LL PEOPLE for $25.9 million. W3LL PEOPLE, a clean beauty company, will help e.l.f. expand its brand and range of products into the sustainable product niche.

The company is focused on strategic extensions of its current brand as a key to long-term growth. Their innovation strategy focuses on three key pillars which include first-to-mass market products, core expansions, and adjacencies. The company’s creative and targeted marketing campaigns are embracing new technologies to cultivate customer relationships.

Most important, they are scaling up through important acquisitions and partnerships. This is clearly exemplified both by the acquisition of W3LL PEOPLE and its recently announced partnership with Alicia Keys. These two strategic moves demonstrate e.l.f.’s commitment to growth in more sustainable and inclusive niche markets. Over the past 15 years, e.l.f has transformed with exits, acquisitions, partnerships, and creative marketing including augmented reality, just to name a few of their strategic plays.

e.l.f. From The Ground Up

Founded in 2004, e.l.f. (for eye. lip. face.) started with about a dozen products and a predominantly online presence. It quickly became an online beauty authority. Ultimately securing permanent in-line displays at many major retailers across the US. The brand features prominently at Ulta Beauty, Walmart, and Target and covers a wide demographic of women, from teens to baby boomers.

Their e-commerce platforms are an important component of their engagement and innovation model. They have nurtured a loyal, highly active online community for over a decade. e.l.f.’s roots as an e-commerce company and their digital engagement model drive conversion on elfcosmetics.com and w3IIpeople.com, where they sell their full product offerings.

e.l.f. became one of the fastest-growing cosmetics brands in the US with its multi-channel distribution strategy, strong digital and social presence, and an integrated global supply chain operation. They closed fiscal year 2020 with net sales of $283 million, up 11% from the prior year. The company has a market value of over $700 million.

e.l.f. Beauty is organized as a holding company. It operates through its principal subsidiaries, e.l.f. Cosmetics, which conducts business under the name "e.l.f. Cosmetics" or "e.l.f." and W3LL People, which conducts business under the name “W3LL PEOPLE,” the result of a recent growth acquisition.

Beauty Care Industry Growth Strategies

In one of the most significant acquisitions of the first half of 2020, e.l.f. Cosmetics acquired clean beauty brand W3LL PEOPLE for $25.9mm. Shortly after e.l.f. announced a partnership with singer Alicia Keys. Strategic growth acquisitions and celebrity partnerships are both trends in the industry.

Core Product Lines

The original 13 products ballooned to more than 300 products including skincare, mineral-based makeup, and beauty tools. Their products are not tested on animals nor do they contain or use ingredients that are tested on animals. e.l.f. Cosmetics has been designated as a “cruelty-free” company by People for the Ethical Treatment of Animals (PETA). e.l.f. Cosmetics products are also free from parabens and phthalates.

The acquisition of W3LL people expanded their ethical product line. W3LL PEOPLE is a pioneer in clean beauty that offers accessible clean beauty products that work. The W3LL PEOPLE portfolio spans the eyes, lips, face, kits, tools, and skincare categories. W3LL PEOPLE’s plant-based product line contains no fillers, propylene glycol, petrochemicals, or petroleum byproducts, and includes forty EWG VERIFIED™ products.

e.l.f.’s Recent Growth Strategy

The company frequently reviews acquisition and strategic investment opportunities that would expand their current product offerings, their distribution channels, increase the size and geographic scope of their operations, or otherwise offer growth and operating efficiency opportunities.

Recent growth strategies include growth via acquisitions, a reorganization and re-digitalization strategy, product innovation, and creative marketing, in part driven by augmented reality and key influencer relationships.

Growth Via Acquisition - W3LL PEOPLE

Strategic Growth Via Acquisition

In February 2020, e.l.f. Cosmetics acquired W3LL PEOPLE for $25.9mm to scale their product range with a respected clean beauty brand. The goal? To elevate their presence in sustainable and environmentally-friendly beauty products.

On February 24, 2020, the Company, through its wholly-owned subsidiary, e.l.f. Cosmetics, acquired beauty brand W3LL PEOPLE, a Santa Fe, New Mexico-based privately held, clean beauty company with a mission to create premium quality cosmetics without using the potentially harmful artificial chemicals found in most conventional makeup.

The purchase price of $25.9 million was in all cash and the total consideration. This acquisition was strategically important as consumers are becoming increasingly conscious of the ingredients in their products. And clean is one of the fastest-growing segments within beauty.

They fully integrated this acquisition onto the e.l.f. platform, realizing synergies and making progress on growth initiatives. They're receiving incredibly positive feedback from their national retail partners, where W3LL PEOPLE is more productive than many other clean beauty brands.

Clean Beauty Trends

Particularly in a COVID-19 world, consumers are more focused than ever in understanding how products are made and where the ingredients are sourced. The W3LL PEOPLE acquisition advances e.l.f.’s growth strategy to meet this increased consumer demand.

Who Is W3LL PEOPLE

Clean beauty is a strategically important business segment for any personal care company. Lifestyle companies like Goop championed the movement. What was once a niche trend has now gone mainstream. COVID-19 related events are making clean beauty even more important as consumers grow more conscious about the ingredients and sources for all household products.

James Walker, Shirley Pinkson and Dr. Renee Snyder launched W3LL PEOPLE in 2008 to provide high-quality, clean cosmetics. The company is cruelty-free, and its plant-based product-line – which contains no fillers, propylene glycol, petrochemicals or petroleum byproducts – includes forty EWG VERIFIED™ products, a leading standard of “clean and healthy” in the beauty space.

W3LL PEOPLE has a long history within the clean beauty niche. In addition to their reputation and credibility within the niche, e.l.f. Believes there are a number of synergies to take advantage of during integration, including cost and distribution. W3LL PEOPLE currently stocks at leading national retailers including Target and Whole Foods as well as online on Amazon, Ulta, and its own branded website.

e.l.f. Beauty acquired cruelty-free, clean beauty company W3LL PEOPLE for $25.9 million in cash. e.l.f. plans to leverage W3LL PEOPLE’s marketing, customer relationships, and operational capabilities to drive the brand. According to Business Wire, e.l.f. expects W3LL PEOPLE to contribute approximately $7 million in net sales and $0.01 to its adjusted earnings per share on a fully diluted basis in fiscal 2021.

IDEA: E-Commerce Expansion

The COVID-19 economy proves it's time to refocus efforts on e-commerce and digitalization to meet the surge in demand for an efficient online sales channel.

e.l.f.’s Re-Digitalization

Another aspect of e.l.f.’s strategic growth plan is a reorganization involving re-digitalization. Although e.l.f. started as an online cosmetics company, they opened about two dozen retail stores across the US. The physical stores cost close to $14 million a year to operate but only represented 5% of total annual sales.

In 2019, the company decided to close all 22 retail stores, along with a workforce reduction. They returned to their roots, taking e.l.f. fully digital once again for direct-to-consumer sales. Retail sales continued in brick-and-mortar stores like Walmart and Target. They successfully redeployed the $13.7 million of savings from e.l.f. stores to their digital and national retailer business.

By redeploying operating expenses and reinvesting in the digital space, e.l.f. Is an industry leader with it comes to augmented reality and unique video content through its

e.l.f Discovery platform, which is their content hub where customers can learn how to play with their make-up and have some fun. This experiment has been a huge success with website visits and app downloads increasing exponentially after the redeployment of retail operating expenses to digital.

e.l.f.’s Innovation Strategy

The company’s innovation strategy is underpinned by three key pillars: first-to-mass, core expansion, and adjacencies.

“First-to-mass” products are inspired by trends in prestige beauty that they bring to the mass market. As consumers are increasingly savvy and knowledgeable about trends in the prestige market, they look for how they can get the best of beauty at an accessible price. The company frequently looks at more luxury products, ranging from $25-75, and creating more accessible versions for the mass-market, with prices around $6.

Core expansion products are those trend-inspired products across eyes, lips, face, and beauty tools that augment their assortment and deliver extraordinary value across price points. They consistently evaluate their core offerings and develop new products based on category trends, consumer feedback, and other market intelligence.

Their adjacencies strategy focuses on launching products that are not part of their core categories. This includes their expansion into the skincare category in 2015.

In early 2020, e.l.f. Announced a strategic partnership with Alicia Keys. More than just a celebrity endorsement, the company plans to innovate alongside Keys in a multi-year, multi-category product pipeline. The partnership is key to embedding a foothold into more inclusive product lines and marketing. Together with the W3LL PEOPLE acquisition, it places e.l.f. in a strong position in the growing sustainable and inclusive segments.

e.l.f.’s Marketing Strategy

The Company deployed a low-cost, consumer-centric marketing model. Total expenses for marketing and digital in the year ended March 31, 2020, were $37.8 million, approximately 13% of their net sales.

Marketing strategies have played a large role in the success of e.l.f. In 2007, they launched a beauty blog on their website offering advice and celebrity appearances. Not long after, the amount of time users spent on their website tripled, and online sales from their site quickly made up over half of their total sales. Using social media marketing, they’ve built up a loyal fan base, and have over 2 million website members.

During fiscal year 2020, e.l.f. launched a new mobile app with a focus on augmented reality, machine learning, and personalization in order to drive more meaningful connections with their customers. Their Beauty Squad loyalty program had 1.8 million members by the end of 2020.

Strategic Growth Strategies

For companies looking to reach the summit of their potential, a strategic growth strategy is imperative. Rather than trudging through and waiting for organic growth, a geometric growth strategy will scale the business and reach the company's goals even in a challenging environment. There are acquisition opportunities to be had in this environment, particularly with companies looking to exit. Learn more in our coverage of Key 2020 Personal Care Acquisitions.

Looking Forward - e.l.f. In FY 2021

Fiscal year 2021 started with significant challenges. The company faces a significant decline in retail sales due to the impact of the COVID-19 pandemic on consumer behavior. They anticipate their sales results to be negatively impacted until consumers return to normal shopping patterns.

They have focused on specific areas as they assess and address the impact of the COVID-19 pandemic on their business. They worked with their suppliers, particularly their Chinese supply chain, to manage inventory levels and adjust based on demand. Their workforce successfully adjusted to working remotely. The company has also taken a number of cost-saving measures

From a product line perspective, skincare is now a more prominent category for the industry. The market is turning more towards quality skincare and self-care over color cosmetics.

It remains unclear what impact the acquisition of W3LL PEOPLE will have on growth and earnings. One trend coming from the COVID-19 pandemic is a desire to better understand the sourcing and sustainability of beauty and skincare products. W3LL PEOPLE could have been a well-timed acquisition by e.l.f. that could lead to substantial growth, which could offset the current market uncertainty. Regardless, e.l.f. is focused on unique opportunities to build market share. Longer-term, the Company remains confident in its core value proposition of delivering quality cosmetics and skincare at extraordinary prices.

They believe their digital strength and core value proposition will enable them to gain market share in the short term. They continue to have a great deal of white space and are confident to be able to return to their long-term economic model once this crisis is over. In summary, they're optimistic in the long-term potential of this company. Not only did they deliver an outstanding FY'20, the company believes they're better positioned than most companies in their space to navigate these challenging times.

Q1 FY 2021 Earnings

On August 5, 2020, e.l.f. announced its first-quarter fiscal year 2021 results.

- 6th consecutive quarter of net sales growth

- Net sales up 8% versus Q1 FY 2020, to $64.5mm

- Gross margin increased to 67%, up almost 500 basis points versus last year

- Adjusted EBITDA increased 7% to $15.5mm versus Q1 FY 2020

- As of June 30, 2020, e.l.f. had $54.2mm in cash and cash equivalents, as compared to $60.7mm in 2019 due primarily to the W3LL PEOPLE acquisition.

CEO Amin concluded “[w]e believe that the successful execution of our strategic imperatives has set the foundation for long-term growth for the e.l.f. brand, as well as a platform for strategic extensions.”